West Red Lake Gold Reports Positive Bulk Sample Reconciliation Results

/EIN News/ -- VANCOUVER, British Columbia, May 07, 2025 (GLOBE NEWSWIRE) -- West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or “WRLG” or the “Company”) (TSXV: WRLG) (OTCQB: WRLGF) is pleased to report positive reconciliation results from the bulk sample program at its 100% owned Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

Highlights

- The bulk sample carried an average grade of 5.72 grams per tonne (“g/t”) gold (“Au”), 0.7% above the average predicted grade of 5.68 g/t Au for six stopes across three areas.

- 14,490 tonnes of bulk sample produced 2,498 ounces of gold

- Gold recovery in the Madsen Mill averaged 95%

“Delivering tonnes and grade from the mine that align almost exactly with expectation validates all the work we have done to unlock the tremendous value in the Madsen Mine,” said Shane Williams, President and CEO. “This achievement underlines that Madsen is on track to become a new high-grade gold mine in 2025 and I want to thank the team at Madsen for their dedicated efforts.”

“We acquired Madsen because we believed an accurate geological model, detailed engineering design, and disciplined mining practices would enable exactly this – a mine that delivers to plan. I am extremely pleased to deliver these bulk sample results and I look forward to ramping up operations at the Madsen Mine in the coming months.”

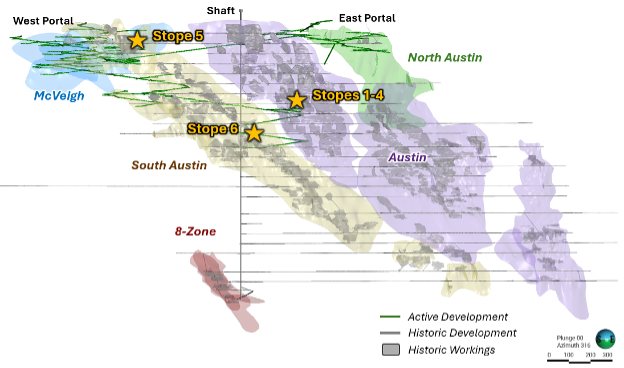

The bulk sample included material from three main resource zones at Madsen - Austin, South Austin, and McVeigh - and followed the workflow and methodology to be implemented during regular mine operations. Close reconciliation between predicted and actual grades and tonnages highlight the effectiveness of definition drilling and detailed stope design in informing accurate modelling of gold mineralization. West Red Lake Gold has completed over 90,000 metres of definition drilling since October 2023 and the high-confidence tonnes resulting from this ongoing program currently make up approximately 90% of the 18-month detailed mine plan.

Figure 1: Madsen Mine long section showing bulk sample locations against resource areas, active development, and historic workings.

Table 1: Reconciliation Results for the Madsen Mine Bulk Sample

| Madsen Mine Bulk Sample | Predicted | Actual | Reconciliation | |

| Austin |

Tonnage (t) | 8,402 | 8,089 | 96.3% |

| Grade (g/t Au) | 5.38 | 5.77 | 107.2% | |

| Gold (oz) | 1,452 | 1,499 | 103.2% | |

| South Austin |

Tonnage (t) | 2,653 | 2,544 | 95.9% |

| Grade (g/t Au) | 5.83 | 5.59 | 95.8% | |

| Gold (oz) | 497 | 457 | 91.9% | |

| McVeigh |

Tonnage (t) | 4,115 | 3,856 | 93.7% |

| Grade (g/t Au) | 6.21 | 5.71 | 91.9% | |

| Gold (oz) | 822 | 708 | 86.1% | |

|

Total |

Tonnage (t) | 15,170 | 14,490 | 95.5% |

| Grade (g/t Au) | 5.68 | 5.72 | 100.7% | |

| Gold (oz) | 2,771 | 2,664 | 96.1% | |

Six stopes were drilled, engineered, and mined using the same workflow the Company plans to implement during regular mine operations at Madsen:

- Each stope area is definition drilled until drill hole spacing averages 7 meters.

- The in-house short-term model is updated to incorporate new drill data.

- Each stope is engineered based on the updated model to maximize economic extraction of mineralization. The resulting tonnes and grade are the basis of the ‘Predicted’ values in Table 1.

“We design stopes to maximize economic benefit in today’s gold price environment. This differs from the Prefeasibility Study (“PFS”), which used a gold price of US$1,680 per ounce when designing stopes,” said Mr. Williams. “Using a gold price just below the long-term consensus gold price of US$2,350 per oz. unlocks significant opportunity at Madsen because, in many areas, a halo of lower-grade mineralization can be profitable to include in the stope design when it surrounds targeted high-grade tonnes. In addition, mining larger stopes can lower mining costs by enabling long hole stoping instead of cut-and-fill methods. We used long hole stoping exclusively in the bulk sample.”

“We are excited by the opportunity to mine additional tonnes and ounces at Madsen, potentially lowering operational costs, increasing production, and enhancing overall economics relative to the PFS mine plan.”

Soutex Inc., an external independent consultant, observed the bulk sample process at the mill in its entirety, including sampling protocols. Day and night shift daily composite samples collected during the processing of the bulk sample were assayed by an accredited third-party lab at SGS Natural Resources’ facility in Red Lake, Ontario. Soutex reconciled the bulk sample results using BILMAT software.

Geology

Mineralization between the McVeigh, Austin and South Austin domains are generally comparable geologically. Structures are hosted within broad, kilometer-scale planar alteration and deformation corridors that have been repeatedly reactivated during gold mineralization and subsequent deformation and metamorphism. Gold-bearing zones at Madsen are best identified visually by sub-millimeter grains of free gold within strong alteration and veining, often accompanied by the presence of arsenopyrite, pyrrhotite, pyrite and more rarely chalcopyrite. Sulphide percentage, though not directly associated with gold grade, typically ranges between 1-5% for mineralized zones. Apart from the presence of free gold, pervasive silicification locally accompanied by discrete quartz veining and quartz-carbonate or diopside veining are the best indicators that a given interval is within a high-grade zone along the mineralized structure.

Mining

The Madsen bulk sample was mined using the long hole retreat mining method. The long hole retreat method requires the mining of two development sills at 20 metres floor-to-floor vertical intervals. While mining the sills, sampling of the face and sidewalls was completed to test the width and grade of the mineralization. A slot raise was drilled and blasted at the far end of the sills, connecting the two sills and creating a breaking point for the stope. After blasting, the raise muck was removed before subsequent blasts were taken to "slice" the stope into the newly created void. Mucking in the stope was done by line of sight enabled remote Load Haul Dumpers (LHD's). Mucked ore was sampled and trucked to surface stockpiles. Muck from the LHD buckets were sampled at regular intervals, using a "dice five" pattern in each bucket.

Three different areas of the mine were subjected to the same Bulk Sampling methodology to ensure a practically representative sample of the orebody. The areas that underwent bulk sampling were McVeigh, Austin, and South Austin complexes. The stoping process was carefully campaigned. Each stope was removed separately to surface and placed in a separate stockpile to ensure no blending of the stope ore took place. A Cavity Monitoring Survey (CMS) was done on each of the completed stope voids. The quantity of LHD buckets, as well as the quantity of truck loads from the stopes were carefully recorded. Once on surface, the completed stockpiles were again scanned to ensure tonnage reconciliation from underground to crusher at the mill.

Processing

The Madsen Mill consists of primary crushing, followed by grinding to 80% passing 75 µm using a semi-autogenous grinding mill and ball mill. Gravity concentration recovers gold from the SAG screen undersize and ball mill discharge. Cyclone overflow is thickened to 50% solids in a pre-leach thickener, then pre-aerated with oxygen followed by a 24-hour cyanide leach at a cyanide concentration of 150-170 ppm and a pH of 11.0 in five leach tanks. Gold in solution is then recovered via carbon-in-pulp (CIP) adsorption in six CIP tanks with a residence time of five hours, followed by acid wash, elution, and refining to produce gold dore on site.

QUALIFIED PERSON

The technical information presented in this news release has been reviewed and approved by Maurice Mostert, P.Eng., Vice President of Technical Services for West Red Lake Gold and the Qualified Person for technical services at the West Red Lake Project, as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

ABOUT WEST RED LAKE GOLD MINES

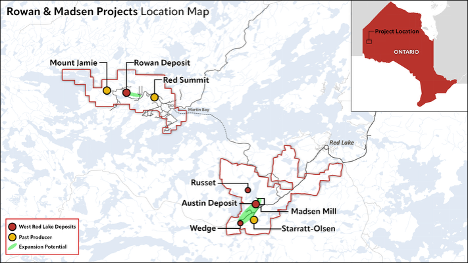

West Red Lake Gold Mines Ltd. is a mineral development company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

“Shane Williams”

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gwen Preston

Vice President Communications

Tel: (604) 609-6132

Email: investors@wrlgold.com or visit the Company’s website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate”, “expect”, “estimate”, “forecast”, “planned”, and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release and include without limitation, statements relating to the plans and timing for the potential production of mining operations at the Madsen Mine, the potential (including the amount of tonnes and grades of material from the bulk sample program) of the Madsen Mine; the benefits of test mining; any untapped growth potential in the Madsen deposit or Rowan deposit; and the Company’s future objectives and plans. Readers are cautioned not to place undue reliance on forward-looking information.

Forward-looking information involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company’s securities; fluctuations in commodity prices; timing and results of the cleanup and recovery at the Madsen Mine; and changes in the Company’s business plans. Forward-looking information is based on a number of key expectations and assumptions, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis for the year ended December 31, 2024, and the Company’s annual information form for the year ended December 31, 2024, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law.

For more information on the Company, investors should review the Company’s continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e613deee-9015-45fa-85f6-34b65ab6be3d

https://www.globenewswire.com/NewsRoom/AttachmentNg/df3e4168-55a3-46a5-84a7-57972f89b7da

Figure 1: Madsen Mine long section showing bulk sample locations against resource areas, active development, and historic workings.

Figure 1: Madsen Mine long section showing bulk sample locations against resource areas, active development, and historic workings.

Madsen and Rowan projects location map

Madsen and Rowan projects location map

Distribution channels: Media, Advertising & PR, Mining Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release